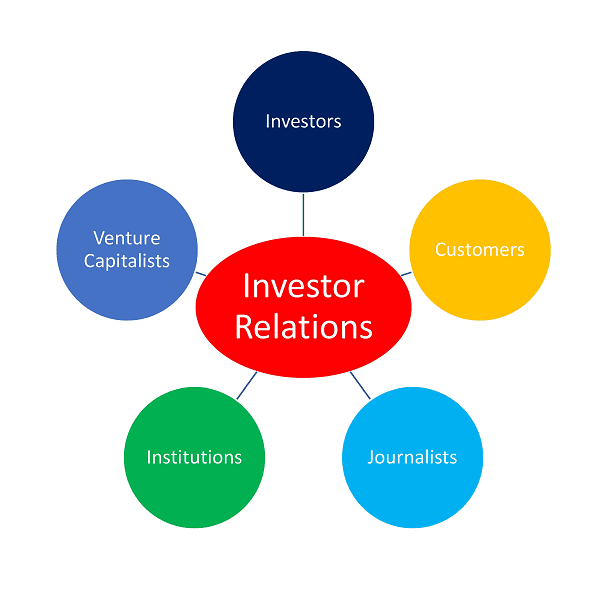

Investor relations (IR) is a critical function within a company that focuses on building and maintaining relationships between a company and its shareholders and potential investors. The primary goal of investor relations is to ensure that the company’s financial performance, strategy, and prospects are effectively communicated to the investment community, including individual and institutional investors, analysts, and other stakeholders. Here are some key aspects of investor relations:

- Communication: IR professionals are responsible for communicating the company’s financial results, business strategy, and other relevant information to the investment community. This communication can take the form of quarterly earnings reports, annual reports, press releases, conference calls, and meetings with investors.

- Transparency: Transparency is a fundamental principle of investor relations. Companies are expected to provide accurate and timely information to investors, ensuring that they have a clear and truthful understanding of the company’s operations and financial health.

- Shareholder Engagement: IR teams engage with existing shareholders to address their questions and concerns. This includes responding to inquiries, participating in shareholder meetings, and providing updates on company performance.

- Investor Targeting: IR professionals identify and target potential investors who may be interested in the company’s stock. This involves analyzing the investor landscape and tailoring the company’s communication strategy to attract and retain investors.

- Financial Reporting: Investor relations teams work closely with the finance and accounting departments to prepare financial statements, annual reports, and other financial documents that are required by regulatory authorities and of interest to investors.

- Market Analysis: IR professionals monitor financial markets, track competitor performance, and analyze industry trends. This information helps the company understand how it is perceived in the market and make strategic decisions accordingly.

- Regulatory Compliance: Investor relations teams ensure that the company complies with all relevant securities regulations, such as the requirements of the U.S. Securities and Exchange Commission (SEC) in the United States.

- Crisis Management: In times of crisis or negative events, IR teams play a crucial role in managing the company’s reputation and mitigating the impact on its stock price. They communicate effectively with investors and the public to maintain trust and confidence.

- Corporate Governance: Investor relations is closely tied to corporate governance practices. Companies that adhere to strong governance principles often have better relationships with investors.

- Strategic Planning: IR professionals provide input and insights to the company’s senior management and board of directors regarding investor sentiment, market trends, and the company’s positioning in the marketplace.

Successful investor relations can contribute to a company’s ability to attract investment, maintain a stable and supportive shareholder base, and achieve fair market valuation. It is a multifaceted discipline that requires strong communication skills, financial acumen, regulatory knowledge, and an understanding of the broader economic and market environment.

What is Investor Relation

Investor Relations (IR) is a strategic management function within a company or organization that focuses on building and maintaining relationships with its shareholders and the broader investment community. The primary goal of investor relations is to facilitate effective communication between the company and its investors, including individual shareholders, institutional investors, analysts, and other stakeholders. Here are key aspects of what investor relations involves:

- Communication: IR professionals are responsible for communicating the company’s financial performance, business strategy, and other relevant information to the investment community. This communication takes various forms, such as quarterly earnings reports, annual reports, press releases, conference calls, and meetings with investors.

- Transparency: Transparency is a core principle of investor relations. Companies are expected to provide accurate and timely information to investors, ensuring that they have a clear and truthful understanding of the company’s operations and financial health.

- Shareholder Engagement: IR teams engage with existing shareholders to address their questions and concerns. This includes responding to inquiries, participating in shareholder meetings, and providing updates on company performance.

- Investor Targeting: IR professionals identify and target potential investors who may be interested in the company’s stock. This involves analyzing the investor landscape and tailoring the company’s communication strategy to attract and retain investors.

- Financial Reporting: Investor relations teams work closely with the finance and accounting departments to prepare financial statements, annual reports, and other financial documents that are required by regulatory authorities and of interest to investors.

- Market Analysis: IR professionals monitor financial markets, track competitor performance, and analyze industry trends. This information helps the company understand how it is perceived in the market and make strategic decisions accordingly.

- Regulatory Compliance: Investor relations teams ensure that the company complies with all relevant securities regulations, such as the requirements of the U.S. Securities and Exchange Commission (SEC) in the United States.

- Crisis Management: In times of crisis or negative events, IR teams play a crucial role in managing the company’s reputation and mitigating the impact on its stock price. They communicate effectively with investors and the public to maintain trust and confidence.

- Corporate Governance: Investor relations is closely tied to corporate governance practices. Companies that adhere to strong governance principles often have better relationships with investors.

- Strategic Planning: IR professionals provide input and insights to the company’s senior management and board of directors regarding investor sentiment, market trends, and the company’s positioning in the marketplace.

Effective investor relations can contribute to a company’s ability to attract investment, maintain a stable and supportive shareholder base, and achieve fair market valuation. It is a multifaceted discipline that requires strong communication skills, financial acumen, regulatory knowledge, and an understanding of the broader economic and market environment.

Who is Required Investor Relation

The need for a dedicated Investor Relations (IR) function within a company is not legally mandated in most jurisdictions, but it is a best practice for many publicly traded companies and some larger private companies. The decision to establish an Investor Relations department or hire an Investor Relations Officer (IRO) typically depends on several factors, including the company’s size, industry, ownership structure, and the importance of communicating with the investment community. Here are some considerations for when a company might require an Investor Relations function:

- Publicly Traded Companies: Companies that have gone public by conducting an initial public offering (IPO) are often required by regulatory authorities, such as the U.S. Securities and Exchange Commission (SEC) in the United States, to have a dedicated IR function. Public companies must adhere to strict reporting and disclosure requirements and engage with shareholders, analysts, and investors regularly.

- Size and Complexity: As a company grows and becomes larger and more complex, the need for effective investor communication and management increases. Larger companies often find it beneficial to have a dedicated IR team or officer to handle the demands of investor engagement.

- Ownership Structure: Companies with a diverse shareholder base, including institutional investors and individual shareholders, may require more extensive investor relations efforts. Institutional investors often have specific information and reporting requirements that necessitate a dedicated IR function.

- Market Perception: Companies that are actively traded in the stock market and those that are frequently covered by analysts and media may find it essential to have an IR function to manage and shape their public image and ensure accurate information is disseminated.

- Strategic Goals: Companies with aggressive growth or expansion plans may also benefit from an IR function to help attract and retain investors who can provide the necessary capital for expansion.

- Legal and Regulatory Compliance: Compliance with securities laws and regulations often requires timely and accurate reporting to investors. A dedicated IR function can help ensure that the company complies with these requirements.

- Investor Relations Activities: If a company is frequently engaged in activities such as mergers and acquisitions, capital raising, or significant changes in strategy, an IR function can be instrumental in managing investor expectations and providing necessary information.

It’s important to note that the decision to establish an Investor Relations department or hire an IRO should be based on a careful assessment of the company’s specific circumstances and needs. Smaller private companies or startups may not have the same level of demand for investor relations activities as larger, publicly traded corporations. However, all companies should consider effective communication with their stakeholders, including investors, as an important aspect of their overall corporate strategy.

When is Required Investor Relation

The decision to establish an Investor Relations (IR) function within a company is not driven by a specific date or time but rather by various factors related to the company’s growth, ownership structure, and regulatory requirements. Here are some common scenarios in which a company might consider establishing or enhancing its Investor Relations function:

- Initial Public Offering (IPO): When a privately held company decides to go public and issue shares on a stock exchange, it typically becomes subject to regulatory requirements mandating the establishment of an IR function. This often happens during the IPO process.

- Post-IPO Growth: After going public, a company may experience significant growth in its shareholder base and market capitalization. As the company becomes more complex and its shareholder relations more demanding, it often becomes necessary to formalize and expand the IR function.

- Ownership Changes: If there are changes in the ownership structure of the company, such as the acquisition of a substantial stake by institutional investors or a change in control through mergers or acquisitions, the company may need to reevaluate its IR function to meet the needs and expectations of its new investor base.

- Increasing Investor Interest: As a company’s stock becomes more actively traded and attracts greater attention from analysts and investors, it may choose to establish or enhance its IR function to manage investor relations more effectively.

- Market Perception and Reputation Management: Companies facing challenges related to their market perception or reputation may benefit from having a dedicated IR team to manage communications, provide accurate information, and address investor concerns.

- Financial Reporting and Compliance: Companies that need to meet strict financial reporting and regulatory compliance requirements, particularly in the case of publicly traded companies, often establish IR functions to ensure timely and accurate reporting to investors.

- Strategic Initiatives: Companies embarking on significant strategic initiatives, such as major expansion plans, restructuring, or capital raising activities, often rely on IR teams to communicate these plans effectively to investors and manage expectations.

- Investor Relations Demand: The company may gauge the level of investor relations demand by monitoring inquiries from shareholders, analysts, and other stakeholders. If there is a consistent need for information and engagement, it may signal the need for a formal IR function.

- Long-Term Growth Plans: Companies with long-term growth ambitions and a focus on attracting and retaining investors as a source of capital may consider establishing an IR function early in their development.

The timing of establishing an Investor Relations function can vary widely depending on these factors and the company’s specific circumstances. Some companies may establish IR functions during their IPO process, while others may do so years after being public. The decision should be based on the company’s unique needs, its growth trajectory, and its commitment to maintaining effective communication with investors and stakeholders.

Where is Required Investor Relation

The establishment of an Investor Relations (IR) function typically occurs within a company or organization itself. It is an internal function responsible for managing communications and relationships between the company and its shareholders and the broader investment community. Here’s where you would typically find the Investor Relations function:

- Within the Company: Most commonly, the Investor Relations department or team operates within the company itself. This department may be part of the company’s corporate communications, finance, or legal department, depending on the company’s organizational structure. The Investor Relations team is responsible for planning and executing IR strategies and activities.

- Reporting Structure: The head of Investor Relations is often referred to as the Investor Relations Officer (IRO) or Director of Investor Relations. The IRO may report directly to the Chief Financial Officer (CFO), Chief Executive Officer (CEO), or another senior executive, depending on the company’s structure and priorities.

- Corporate Headquarters: The Investor Relations team is typically based at the company’s corporate headquarters or main office location. This is where they coordinate investor communications, prepare financial reports, and engage with shareholders and the investment community.

- Virtual or Remote: In some cases, particularly with smaller companies or those with a distributed workforce, the Investor Relations function may operate in a virtual or remote capacity. Team members can work from various locations but remain connected through digital communication tools.

- Engagement Locations: While the IR function is primarily an internal role, members of the Investor Relations team often engage with investors, analysts, and other stakeholders in various locations. This engagement can include participating in conference calls, attending investor conferences, and conducting meetings with shareholders, which may take place at the company’s offices or other locations.

The location of the Investor Relations function within the company’s organizational structure can vary from one organization to another. It is important for the IR team to work closely with other departments, such as finance, legal, and corporate communications, to ensure effective communication with investors and compliance with regulatory requirements.

If you are looking for information about a specific company’s Investor Relations department, you can typically find contact details and information on the company’s official website, often under a section titled “Investor Relations” or “Investor Relations Contacts.” This is where you can find resources and contact information if you have questions or need to get in touch with the company regarding its financial performance or other investor-related matters.

How is Required Investor Relation

The establishment and management of an Investor Relations (IR) function within a company involve several steps and considerations to ensure its effectiveness. Here’s how to set up and manage a required Investor Relations function:

- Assess the Need:

- Determine whether there is a need for an IR function within your company. Consider factors such as the company’s size, ownership structure, growth trajectory, and regulatory requirements.

- Define Objectives and Scope:

- Clearly define the objectives and scope of the IR function. Determine the primary goals, such as enhancing communication with investors, managing shareholder relations, and ensuring compliance with regulatory requirements.

- Create an IR Team:

- Assemble a team responsible for investor relations. This team may include an Investor Relations Officer (IRO), financial analysts, and communication professionals. Ensure that team members have the necessary skills and expertise in finance, communications, and regulatory compliance.

- Establish Reporting Lines:

- Determine the reporting structure of the IR team within the organization. The head of Investor Relations (IRO) may report to the CFO, CEO, or another senior executive, depending on the company’s structure.

- Develop a Communication Plan:

- Create a comprehensive communication plan that outlines how the company will communicate with shareholders and the investment community. This plan should cover quarterly earnings releases, annual reports, conference calls, investor presentations, and other communication channels.

- Prepare Financial Reporting:

- Ensure that the IR team works closely with the finance and accounting departments to prepare accurate and timely financial reports, including quarterly and annual financial statements, as required by regulatory authorities.

- Monitor Regulatory Compliance:

- Stay informed about the regulatory requirements that apply to your company. Ensure that the IR function complies with securities laws and regulations, including filing required documents with regulatory authorities.

- Engage with Shareholders:

- Actively engage with existing shareholders, respond to inquiries, and participate in shareholder meetings. Keep shareholders informed about company performance, strategy, and developments.

- Investor Targeting:

- Identify and target potential investors who may be interested in the company’s stock. Analyze the investor landscape and tailor communication strategies to attract and retain investors.

- Market Analysis:

- Continuously monitor financial markets, track competitor performance, and analyze industry trends. Use this information to understand how the company is perceived in the market and make strategic decisions accordingly.

- Crisis Management:

- Develop a crisis management plan for handling negative events or challenging situations. Ensure that the IR team is prepared to communicate effectively with investors and the public during such times.

- Corporate Governance:

- Emphasize strong corporate governance practices, including transparency and ethical conduct, which can enhance relationships with investors.

- Continuous Improvement:

- Regularly review and assess the effectiveness of the IR function. Seek feedback from investors and stakeholders to make improvements in communication and engagement.

- Investor Relations Technology:

- Consider using Investor Relations technology and software platforms that can help streamline communication, manage investor data, and track engagement with investors.

- Training and Development:

- Provide ongoing training and professional development for the IR team to ensure they stay updated on best practices, industry trends, and regulatory changes.

- Maintain an IR Website: Consider maintaining a dedicated Investor Relations section on the company’s website where investors can easily access important information and reports.

Effective Investor Relations requires a proactive and strategic approach to communicate the company’s financial performance and strategic plans to shareholders and the investment community. It plays a crucial role in building trust and confidence among investors and stakeholders.

Case Study on Investor Relation

XYZ Corporation

Background: XYZ Corporation is a publicly traded technology company that specializes in developing software solutions for businesses. The company went public three years ago and is listed on a major stock exchange. Since its IPO, XYZ has experienced rapid growth and has a diverse shareholder base, including institutional investors, individual shareholders, and analysts covering its stock.

Scenario: Over the past year, XYZ Corporation has faced several challenges and opportunities in managing its Investor Relations function.

Challenges:

- Earnings Miss: In the most recent quarter, XYZ reported lower-than-expected earnings due to increased competition and a slowdown in a key market. This resulted in a significant drop in the company’s stock price, causing concern among investors.

- Rumors and Speculation: In response to the earnings miss, rumors and speculation about potential leadership changes and strategic shifts began to circulate in the media and on social networks, adding to the volatility of the company’s stock.

- Shareholder Activism: A prominent institutional investor, holding a substantial stake in XYZ, expressed dissatisfaction with the company’s performance and called for changes in the board of directors. This led to increased scrutiny from other shareholders.

Actions Taken:

- Communication Strategy: The IR team immediately developed a comprehensive communication strategy to address the earnings miss. They scheduled a conference call with analysts and investors to provide transparent and detailed explanations of the company’s financial performance and the steps being taken to address challenges.

- Crisis Management: To counter the rumors and speculation, the IR team worked closely with the company’s legal and PR teams to issue official statements clarifying the situation. They also held a media briefing to address questions and concerns.

- Engagement with Activist Shareholder: The IR team initiated direct discussions with the activist shareholder to better understand their concerns and explore potential solutions. They also engaged with other major shareholders to garner support for the current board of directors.

Results:

- Earnings Recovery: Through transparent communication and a clear plan to address challenges, XYZ Corporation managed to rebuild investor confidence. The subsequent quarters showed improved financial performance.

- Rumors Quashed: The official statements and media briefing successfully quashed the rumors and speculation surrounding the company. This helped stabilize the stock price and restore market confidence.

- Shareholder Support: Through open dialogue and engagement with the activist shareholder and other major investors, the company managed to avoid a board shake-up. Instead, they worked together to identify areas of improvement and agreed on a path forward.

Key Takeaways:

This case study highlights the critical role of Investor Relations in managing both opportunities and challenges for a publicly traded company. Effective communication, transparency, and proactive engagement with investors are essential components of a successful IR function. By addressing challenges head-on and maintaining open lines of communication, companies like XYZ Corporation can maintain investor trust and weather periods of uncertainty.

White paper on Investor Relation

Creating a comprehensive white paper on Investor Relations (IR) would require an extensive document. However, I can provide you with an outline of topics that you might consider including in such a white paper. You can then expand on each of these topics to create a detailed and informative resource on IR.

Title: “Navigating the World of Investor Relations: Strategies for Effective Communication and Engagement”

Table of Contents:

- Introduction

- Definition and Importance of Investor Relations

- Purpose of the White Paper

- The Role of Investor Relations

- The Evolution of IR

- The IR Function Within the Organization

- IR as a Strategic Function

- Regulatory Environment

- Securities Laws and Regulations

- Disclosure Requirements

- Compliance and Reporting

- Stakeholders in Investor Relations

- Shareholders (Institutional and Retail)

- Analysts and Financial Media

- Regulatory Authorities

- Key Responsibilities of Investor Relations

- Communication Strategies

- Financial Reporting and Disclosure

- Shareholder Engagement

- Crisis Management

- IR Best Practices

- Building Trust and Credibility

- Transparency and Disclosure

- Technology and Investor Relations

- Shareholder Meetings and Events

- IR During Critical Events

- IPO and Going Public

- Earnings Announcements

- Mergers and Acquisitions

- Handling Crises

- Corporate Governance and Investor Relations

- Corporate Governance Principles

- IR’s Role in Governance

- The Link Between Governance and Investor Confidence

- IR Tools and Technology

- Investor Relations Websites

- IR Software and Platforms

- Social Media and IR

- Data Analytics and Investor Relations

- Measuring IR Effectiveness

- Key Performance Indicators (KPIs)

- Share Price Performance

- Investor Satisfaction Surveys

- IR Trends and Emerging Practices

- Environmental, Social, and Governance (ESG) Reporting

- Virtual and Hybrid Investor Engagement

- The Impact of COVID-19 on IR

- Case Studies

- Real-world examples of successful IR practices and challenges faced by companies.

- Conclusion

- The Future of Investor Relations

- The Ongoing Evolution of IR

- Additional Resources

- References and Further Reading

- Glossary of IR Terms

Remember to provide relevant statistics, examples, and real-world insights throughout the white paper to make it informative and engaging for readers. You may also want to include charts, graphs, and visuals to illustrate key points. Additionally, consider consulting with professionals or experts in the field of IR to ensure that your white paper provides accurate and up-to-date information.