Syllabus Of Mutual Fund Management

Semester 1: Fundamentals of Mutual Funds

Semester 2: Portfolio Management and Analysis

Semester 3: Advanced Topics and Strategies

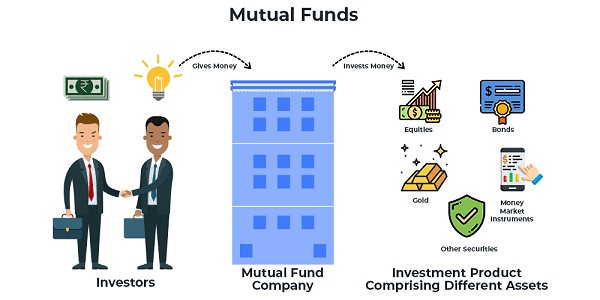

Mutual Fund Management- Mutual fund management involves the operation and oversight of mutual funds, which are investment vehicles that pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. These funds are managed by professional fund managers or management teams with the goal of generating returns for the fund’s investors.

Here are the key aspects of mutual fund management:

- Portfolio Management: The core responsibility of mutual fund managers is to create and manage the fund’s investment portfolio. This involves selecting the securities (stocks, bonds, or a mix of both) that the fund will invest in, with the aim of achieving the fund’s investment objectives and strategy.

- Asset Allocation: Fund managers decide how to allocate the fund’s assets among different asset classes and securities to balance risk and return. Asset allocation involves determining the percentage of the portfolio invested in stocks, bonds, cash, and other asset classes.

- Research and Analysis: Fund managers conduct in-depth research and analysis to identify investment opportunities and make informed investment decisions. This includes analyzing financial statements, market trends, economic data, and company performance.

- Risk Management: Managing risk is a crucial aspect of mutual fund management. Fund managers must assess and mitigate risks associated with the investments in the portfolio. They may use diversification, hedging strategies, and other risk management techniques to protect investors’ capital.

- Performance Monitoring: Fund managers continually monitor the performance of the fund’s portfolio and make adjustments as necessary. They may buy or sell securities based on market conditions and the fund’s investment objectives.

- Compliance and Regulation: Mutual funds are subject to regulatory oversight to protect investors. Fund managers must ensure that the fund complies with all applicable laws and regulations, including disclosure requirements and investment restrictions.

- Reporting and Communication: Fund managers communicate with investors through regular reports, prospectuses, and other documents. They provide information on the fund’s performance, holdings, and fees.

- Fees and Expenses: Mutual fund managers charge fees for their services, including management fees and, in some cases, performance-based fees. These fees are typically expressed as an expense ratio, which represents the percentage of the fund’s assets used to cover expenses.

- Distribution and Sales: Mutual fund management companies also handle the distribution and sale of fund shares. This involves marketing the fund to investors and facilitating the buying and selling of shares through various distribution channels.

- Customer Service: Fund management companies typically provide customer service to address investor inquiries, account management, and other investor-related activities.

It’s important for investors to carefully consider the investment objectives, risk tolerance, and fees associated with mutual funds before investing. Additionally, understanding the track record and expertise of the fund management team is crucial when evaluating mutual funds as potential investment options.

What is Mutual Fund Management

Mutual fund management refers to the process of overseeing and running a mutual fund. A mutual fund is an investment vehicle that pools money from many investors to purchase a diversified portfolio of stocks, bonds, or other securities. Mutual fund management involves various tasks and responsibilities, typically carried out by a team of professionals, including portfolio managers, analysts, and administrators. Here are the key components of mutual fund management:

- Portfolio Management: This is one of the core functions of mutual fund management. Portfolio managers are responsible for selecting and managing the securities held within the fund’s portfolio. They make investment decisions based on the fund’s objectives and investment strategy, aiming to achieve the fund’s goals while managing risk.

- Asset Allocation: Portfolio managers determine how the fund’s assets should be allocated among different asset classes (e.g., stocks, bonds, cash) to achieve diversification and meet the fund’s investment objectives. The allocation may change over time based on market conditions and the fund’s strategy.

- Research and Analysis: Fund managers and analysts conduct extensive research and analysis of potential investments. They assess the financial health, performance, and prospects of individual securities, industries, and markets to make informed investment decisions.

- Risk Management: Managing risk is a crucial aspect of mutual fund management. Fund managers employ various risk management techniques, such as diversification, hedging, and asset selection, to mitigate potential losses and protect investors’ capital.

- Performance Monitoring: Fund managers continually monitor the performance of the fund’s portfolio. They track the investments’ performance against benchmarks and assess whether the fund is meeting its stated objectives. Adjustments to the portfolio may be made as needed.

- Compliance and Regulation: Mutual funds are subject to regulatory oversight, and fund managers must ensure that the fund complies with all relevant securities laws and regulations. This includes reporting requirements, disclosure to investors, and adherence to investment restrictions.

- Reporting and Communication: Fund managers provide regular reports to investors, including prospectuses, annual reports, and periodic updates on fund performance. Clear communication with investors is essential to maintain transparency and trust.

- Fees and Expenses: Mutual fund management companies charge fees for their services, which are typically expressed as an expense ratio. These fees cover management fees, administrative costs, and other expenses associated with running the fund.

- Distribution and Sales: Mutual fund management companies also handle the distribution and sale of fund shares. They market the fund to investors through various channels, such as financial advisors, online platforms, and direct sales.

- Customer Service: Fund management companies offer customer service to investors, addressing inquiries, providing account management services, and assisting with transactions.

Effective mutual fund management aims to achieve the fund’s investment objectives while providing investors with professional management, diversification, and liquidity. Investors should carefully review a fund’s prospectus and consider factors such as performance history, fees, and the expertise of the management team before investing in a mutual fund.

Who is Required Mutual Fund Management

Mutual fund management is typically carried out by professionals and organizations that are responsible for the day-to-day operations and decision-making of a mutual fund. Here are the key individuals and entities involved in mutual fund management:

- Portfolio Managers: Portfolio managers are the individuals primarily responsible for making investment decisions on behalf of the mutual fund. They analyze securities, decide which assets to buy or sell, and manage the fund’s portfolio to achieve its investment objectives. Portfolio managers often work within fund management companies or asset management firms.

- Fund Management Companies: These are organizations that create and manage mutual funds. They are responsible for establishing the fund’s investment objectives, strategies, and policies. Fund management companies employ portfolio managers and other professionals to run the fund, make investment decisions, and ensure compliance with regulations.

- Investment Advisers: Many mutual funds have external investment advisers or advisory firms that provide expertise in managing the fund’s assets. These advisers are often hired by the fund management company to assist in investment decisions and strategies.

- Investment Analysts: Investment analysts conduct research and analysis of individual securities, industries, and markets to assist portfolio managers in making informed investment decisions. They provide critical information and recommendations based on their analysis.

- Fund Administrators: Fund administrators handle the administrative and operational aspects of the mutual fund, including accounting, record-keeping, and processing of investor transactions. They ensure that the fund operates smoothly and efficiently.

- Compliance Officers: These professionals are responsible for ensuring that the mutual fund complies with all relevant securities laws and regulations. They oversee regulatory reporting, disclosures, and adherence to investment restrictions.

- Sales and Distribution Teams: Mutual fund management companies often have sales and distribution teams that market the fund to investors. They may work with financial advisors, broker-dealers, and other distribution channels to promote the fund’s shares.

- Customer Service Representatives: Customer service teams assist investors with inquiries, account management, and transaction processing. They provide support to investors and ensure a positive investor experience.

- Trustees or Boards of Directors: Mutual funds typically have a board of directors or trustees responsible for overseeing the fund’s operations and protecting the interests of shareholders. They appoint key officers, review fund performance, and make decisions regarding fund policies.

- Auditors and Legal Counsel: Auditors ensure the accuracy of the fund’s financial statements and compliance with accounting standards. Legal counsel provides legal advice on regulatory and compliance matters.

- Custodians: Custodians are financial institutions responsible for holding and safeguarding the fund’s assets, such as securities and cash. They play a critical role in asset protection and ensuring the integrity of the fund’s holdings.

- Transfer Agents: Transfer agents are responsible for maintaining records of shareholder ownership, processing purchases and redemptions of fund shares, and distributing dividends and other distributions to investors.

The individuals and entities involved in mutual fund management work collectively to achieve the fund’s investment goals, comply with regulations, and provide services to investors. It’s important for investors to research and understand the qualifications and track record of the management team when considering an investment in a mutual fund.

When is Required Mutual Fund Management

Mutual fund management is required throughout the entire life cycle of a mutual fund, from its inception to its liquidation. Here are the key stages and instances where mutual fund management is required:

- Fund Inception: When a mutual fund is created, mutual fund management begins. This involves establishing the fund’s investment objectives, strategies, policies, and other operational details.

- Portfolio Management: Mutual fund management is an ongoing process that includes the day-to-day management of the fund’s investment portfolio. Portfolio managers continuously make decisions about which securities to buy or sell to align with the fund’s objectives.

- Investor Transactions: Mutual fund management is involved when investors buy or redeem shares of the fund. When investors purchase shares, the fund management ensures that the funds are invested according to the fund’s strategy. When investors redeem shares, the management ensures that the necessary assets are liquidated to meet redemption requests.

- Research and Analysis: Mutual fund management requires ongoing research and analysis of financial markets, individual securities, and economic conditions. This research informs investment decisions and helps manage risk.

- Asset Allocation: Asset allocation decisions, such as adjusting the mix of stocks, bonds, and other asset classes within the portfolio, are part of the ongoing mutual fund management process. These decisions are influenced by market conditions and the fund’s investment objectives.

- Performance Monitoring: Fund managers continuously monitor the performance of the fund’s portfolio to ensure it aligns with the fund’s goals and objectives. Adjustments to the portfolio may be made to enhance performance or manage risk.

- Regulatory Compliance: Mutual fund management is responsible for ensuring that the fund complies with all applicable securities laws and regulations. This includes reporting requirements, disclosure to investors, and adherence to investment restrictions.

- Reporting and Communication: Fund managers provide regular reports to investors, including prospectuses, annual reports, and updates on fund performance. Clear and transparent communication with investors is essential.

- Distribution and Sales: Fund management companies are responsible for marketing and distributing the fund’s shares to investors through various channels, including financial advisors, broker-dealers, and online platforms.

- Fees and Expenses: Mutual fund management includes the assessment and collection of fees and expenses associated with managing and operating the fund. These fees are typically expressed as an expense ratio and cover various costs, including management fees and administrative expenses.

- Liquidation: When a mutual fund reaches the end of its life cycle or is terminated, mutual fund management oversees the liquidation process, which involves selling off the fund’s assets and distributing the proceeds to shareholders.

Mutual fund management is an ongoing and dynamic process that requires constant attention to market conditions, investor needs, and regulatory requirements. It is the responsibility of the fund management company and its professionals to ensure the fund operates effectively and in the best interest of its shareholders throughout its existence.

Where is Required Mutual Fund Management

Mutual fund management is required wherever mutual funds are established and operated. This management occurs within financial institutions, investment companies, or asset management firms that create and manage mutual funds. Here are the key places where mutual fund management is required:

- Mutual Fund Management Companies: Mutual fund management companies are at the heart of the mutual fund industry. These companies are responsible for creating, launching, and managing mutual funds. They employ portfolio managers, analysts, compliance officers, and other professionals who oversee the day-to-day operations of the funds.

- Portfolio Management Offices: Portfolio managers and their teams work in dedicated offices or departments within the management company. They analyze securities, make investment decisions, and manage the fund’s portfolio. These offices often have research facilities and access to market data and analysis tools.

- Asset Management Firms: Many mutual funds are managed by large asset management firms that offer a wide range of investment products and services. These firms may manage multiple mutual funds across various asset classes and investment strategies.

- Investment Advisory Firms: Some mutual funds employ external investment advisory firms to provide expertise in managing the fund’s assets. These firms may work closely with the fund management company to develop and implement investment strategies.

- Compliance and Regulatory Bodies: Mutual funds are subject to regulatory oversight in the regions or countries where they operate. Compliance officers and legal professionals within mutual fund management companies ensure that the funds adhere to all relevant securities laws and regulations.

- Financial Advisor Offices: Mutual funds are often distributed through financial advisors and broker-dealer networks. These advisors assist clients in selecting appropriate mutual funds based on their financial goals and risk tolerance.

- Transfer Agents: Mutual fund transfer agents play a role in managing shareholder accounts and processing transactions. They have offices or facilities dedicated to handling investor inquiries and account management.

- Custodian Banks: Custodian banks are responsible for safeguarding the fund’s assets, such as securities and cash. They have offices and facilities dedicated to the safekeeping of these assets.

- Auditors and Legal Counsel: Auditors and legal professionals who ensure compliance with accounting standards and regulatory requirements often have offices within mutual fund management companies.

- Distribution Channels: Mutual funds are distributed and marketed to investors through various channels, including online platforms, financial institutions, and advisory firms. These distribution channels may have offices or branches where investors can access information about mutual funds.

Mutual fund management requires a coordinated effort across these various locations and entities to ensure the fund operates in accordance with its stated objectives and within legal and regulatory frameworks. The goal is to provide professional management, transparency, and investor services to individuals and institutions interested in investing in mutual funds.

How is Required Mutual Fund Management

Mutual fund management is essential for the successful operation and administration of mutual funds. Here’s how mutual fund management is carried out:

- Establishment and Fund Creation:

- The process begins with the establishment of a mutual fund, which involves defining the fund’s investment objectives, strategies, and policies.

- A management company or asset management firm decides to create a new mutual fund to serve specific investment goals and target investors.

- Fund Management Team:

- A team of professionals is assembled to manage the mutual fund. This team typically includes portfolio managers, investment analysts, compliance officers, and administrative staff.

- Portfolio managers are responsible for making investment decisions, and their experience and expertise are crucial to the fund’s success.

- Investment Strategy Development:

- The management team develops an investment strategy that aligns with the fund’s objectives. This includes determining the asset allocation, sector focus, and risk management approach.

- Investment analysts conduct research to identify potential securities and investments that fit the strategy.

- Portfolio Construction and Security Selection:

- Portfolio managers construct the fund’s portfolio by selecting specific securities (stocks, bonds, etc.) based on the approved investment strategy.

- Decisions are made regarding which assets to buy, how much to buy, and when to buy or sell securities within the portfolio.

- Risk Management:

- Risk management is an integral part of mutual fund management. Portfolio managers employ various risk mitigation strategies, including diversification, hedging, and asset selection, to manage and control risk.

- Ongoing Monitoring:

- The fund’s portfolio is continually monitored to assess its performance against benchmarks and objectives.

- Regular reviews ensure that the portfolio remains aligned with the fund’s investment strategy.

- Regulatory Compliance:

- Compliance officers within the management company ensure that the mutual fund complies with all applicable securities laws and regulations.

- Regulatory requirements include disclosures, reporting, and adherence to investment restrictions.

- Reporting and Communication:

- Fund management companies provide regular reports and communications to investors. This includes prospectuses, annual reports, and updates on fund performance.

- Clear and transparent communication is crucial for maintaining investor trust.

- Distribution and Sales:

- Fund management companies market and distribute the fund’s shares to investors through various channels, including financial advisors, broker-dealers, and online platforms.

- Sales and distribution teams work to attract investors and meet their needs.

- Fee Management:

- Management companies assess and collect fees associated with managing and operating the fund. These fees cover expenses such as management fees and administrative costs.

- Investor Services:

- Customer service representatives assist investors with inquiries, account management, and transaction processing.

- Transfer agents handle the administration of shareholder accounts and processing of investor transactions.

- Performance Evaluation:

- The fund’s performance is regularly evaluated against its benchmarks and peer group.

- Adjustments to the portfolio may be made based on market conditions and performance results.

- Liquidation (if applicable):

- When a mutual fund reaches the end of its life cycle or is terminated, the management team oversees the liquidation process, which involves selling off the fund’s assets and distributing the proceeds to shareholders.

Mutual fund management requires a well-coordinated effort by the fund management company and its professionals to ensure that the fund operates effectively, adheres to its stated objectives, and provides a valuable investment option for shareholders. The ultimate goal is to generate returns for investors while managing risk and adhering to regulatory requirements.

Case Study on Mutual Fund Management

Alpha Investment Fund

Background: Alpha Investment Fund is a mutual fund launched by ABC Asset Management Company, a reputable financial institution with a history of successful fund management. The fund’s primary objective is to provide long-term capital appreciation by investing primarily in a diversified portfolio of U.S. equities. It targets individual and institutional investors looking for exposure to the U.S. stock market.

Key Players:

- ABC Asset Management Company: The fund management company responsible for establishing and overseeing the Alpha Investment Fund.

- Portfolio Management Team: Led by Sarah Johnson, a seasoned portfolio manager with over 15 years of experience in U.S. equity markets.

- Investment Analysts: A team of analysts responsible for conducting research on U.S. stocks and identifying potential investment opportunities.

- Compliance Officer: Ensures that Alpha Investment Fund complies with all relevant securities laws and regulations.

- Distribution Team: Responsible for marketing and distributing fund shares to various channels, including financial advisors and online platforms.

- Custodian Bank: Safeguards the fund’s assets and ensures the integrity of the portfolio.

Management Process:

- Fund Inception:

- Alpha Investment Fund is launched by ABC Asset Management Company, outlining its investment objectives, strategy, and risk profile in its prospectus.

- Portfolio Construction:

- Sarah Johnson and her team develop an investment strategy that emphasizes active stock selection within the U.S. equity market.

- Investment analysts conduct research on various U.S. companies, assessing financial health, competitive positioning, and growth prospects.

- Security Selection:

- Based on research and analysis, the portfolio management team selects a diversified portfolio of U.S. stocks. They aim to outperform the benchmark index.

- Asset Allocation:

- The fund maintains a balanced allocation across sectors, taking into consideration factors such as market conditions, economic indicators, and potential risks.

- Risk Management:

- The portfolio is continuously monitored to ensure that risk is managed effectively. Diversification across sectors and stocks helps reduce risk.

- Regulatory Compliance:

- The compliance officer ensures that the fund complies with U.S. securities laws, including periodic reporting and disclosures to investors.

- Performance Monitoring:

- The fund’s performance is reviewed regularly against its benchmark index (e.g., S&P 500). Adjustments to the portfolio are made as needed to improve performance.

- Reporting and Communication:

- The management company provides quarterly reports to investors, detailing fund performance, holdings, and expenses. They also communicate any changes to the fund’s strategy or team.

- Distribution and Sales:

- The distribution team markets Alpha Investment Fund to financial advisors, who recommend the fund to their clients based on their investment goals and risk tolerance.

- Fee Management:

- Alpha Investment Fund charges a management fee, which covers portfolio management and administrative expenses.

- Investor Services:

- Customer service representatives handle investor inquiries, facilitate purchases and redemptions, and provide account management assistance.

- Performance Evaluation:

- The fund’s performance is evaluated annually in comparison to its benchmarks and peer group. Adjustments to the portfolio are made based on performance results.

Outcome:

- Alpha Investment Fund consistently outperforms its benchmark index over the years, attracting both individual and institutional investors seeking exposure to the U.S. equity market.

- The fund complies with all regulatory requirements, maintaining transparency and trust with investors.

- The management team’s expertise and disciplined approach to risk management contribute to the fund’s success.

- The fund’s assets under management (AUM) grow significantly, reflecting investor confidence in the management team’s abilities.

This case study demonstrates the multifaceted process of mutual fund management, from fund inception and strategy development to portfolio construction, risk management, compliance, and investor services. The successful management of Alpha Investment Fund highlights the importance of skilled professionals, research-driven decision-making, and adherence to regulatory standards in the mutual fund industry.

White paper on Mutual Fund Management

Title: Navigating the World of Investment Vehicles

I. Executive Summary

- Brief overview of mutual funds and their significance in the financial industry.

- Summary of key findings and insights discussed in the white paper.

- Highlights of the challenges and opportunities in mutual fund management.

II. Introduction

- Definition and explanation of mutual funds.

- Historical evolution of mutual funds and their role in investment portfolios.

- Purpose and objectives of the white paper.

III. Mutual Fund Basics

- Detailed explanation of what mutual funds are and how they operate.

- Types of mutual funds (equity, bond, money market, index, etc.).

- Advantages and disadvantages of investing in mutual funds.

IV. Mutual Fund Management Process

- Portfolio construction: Asset allocation, security selection, and diversification.

- The role of portfolio managers and investment analysts.

- Risk management strategies employed in mutual fund management.

V. Regulatory Environment

- Overview of regulatory oversight in the mutual fund industry.

- Key regulations and laws (e.g., SEC regulations in the United States).

- Compliance requirements for mutual fund managers.

VI. Performance Measurement and Evaluation

- How mutual fund performance is measured and benchmarked.

- Evaluation of past performance vs. investment objectives.

- The importance of fees and expenses in assessing fund performance.

VII. Investor Considerations

- Factors investors should consider when evaluating mutual funds.

- The importance of aligning fund choice with investment goals and risk tolerance.

- Tax considerations and implications of investing in mutual funds.

VIII. Technology and Innovation in Mutual Fund Management

- The role of technology in portfolio analysis and trading.

- Trends in robo-advisors and automated fund management.

- Innovations in data analytics and AI for fund management.

IX. Case Studies

- Real-world examples of successful mutual fund management strategies.

- Analysis of funds that have consistently outperformed their benchmarks.

- Lessons learned from both successful and unsuccessful cases.

X. Future Trends and Challenges

- Predictions for the future of mutual fund management.

- Challenges and opportunities, including market trends and regulatory changes.

- The impact of environmental, social, and governance (ESG) investing on mutual funds.

XI. Conclusion

- Recap of key takeaways from the white paper.

- Emphasis on the importance of professional management in mutual funds.

- Encouragement for investors to make informed decisions when choosing mutual funds.

XII. References

- A list of sources, articles, and research papers used in the white paper.

This outline provides a structured framework for a white paper on Mutual Fund Management, which you can expand upon by adding detailed information, analysis, charts, and examples in each section to create a comprehensive document.